- Category

- Private Funds Blog

- Date

- May 31, 2023

- Title

-

Adam Smith Explains ESG Fund Demand

The growth of social impact and ESG funds is an expression of free markets responding to investor demand.

In recent news cycles devoted to social impact and ESG investing, an essential storyline — as told by the data and professional investors — risks getting lost. At their foundation, ESG investment vehicles are an expression of Adam Smith’s “enlightened self-interest”; they are in accord with basic market principles, deploying private capital in response to investor demand, being judged on financial returns as well as ESG benefits.

Analysts and academics have been marking the increasing demand trend for years, and as the Financial Times noted this February, more major private equity firms are responding to that demand by creating offerings in this space. Let’s take a closer look.

Social impact funds

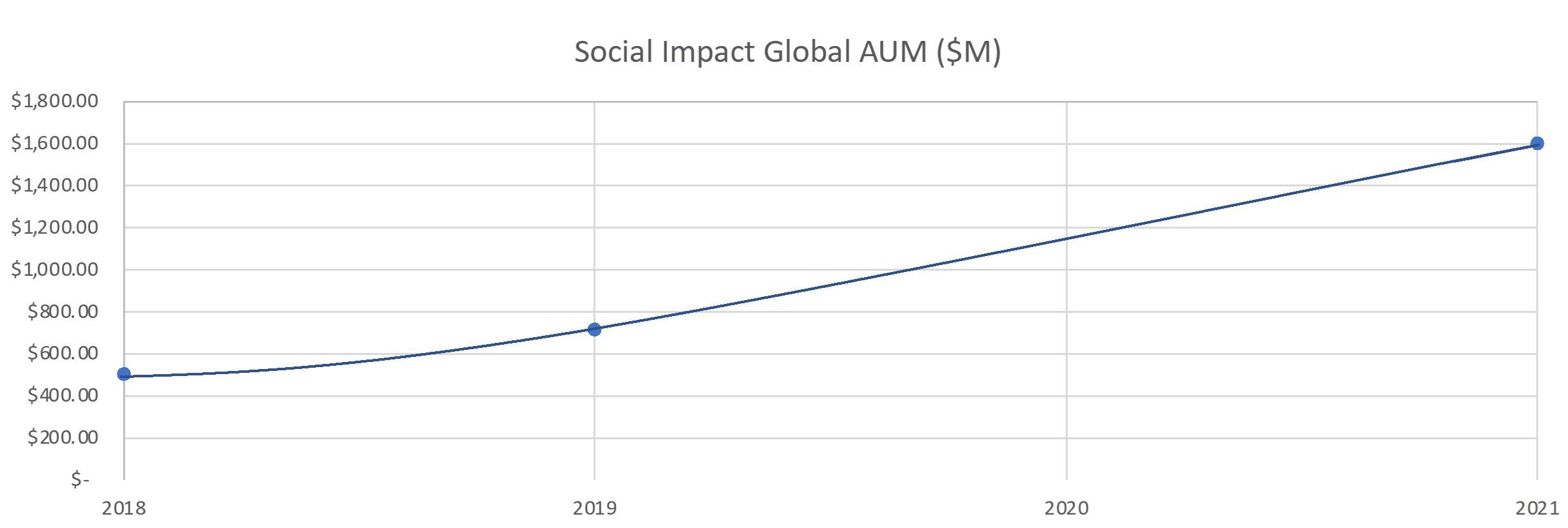

- Assets under management (AUM): The AUM growth of social impact funds reflects investor demand and performance. Estimates of the global AUM for social impact funds have grown dramatically in the past five years, more than doubling from $502 billion in 2018 to $1.16 trillion by the end of 2021, according to the Global Impact Investing Network. (Fig. 1)

ESG funds

- AUM growth: Although net ESG fund assets contracted in the first half of 2022, the trend over the past three quarters, like the past five years, has been one of steady growth, according to Morningstar data. (Fig. 2)

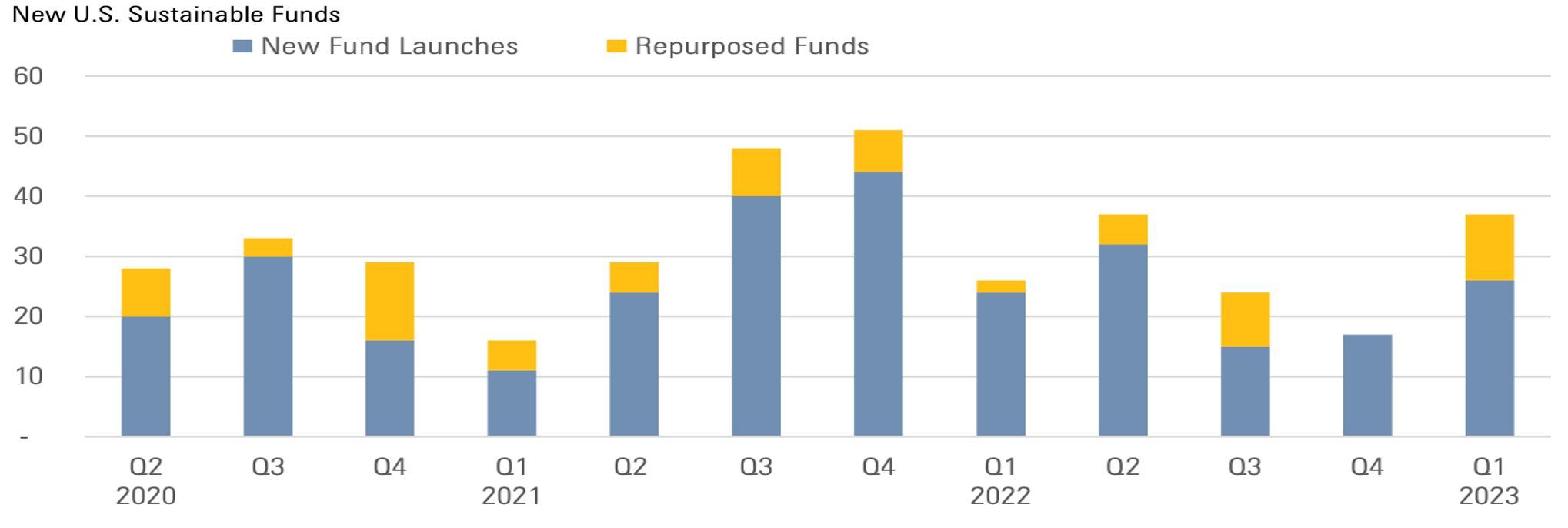

- Product development: Asset managers develop new funds in response to investor demand and market opportunity. The steady stream of new ESG fund launches — and conversion of traditional funds that have changed their investment strategies — indicates that managers see sustained demand and expect continued growth. (Fig. 3)

- Long-term financial performance: Despite a softer 2022, analysts looking at registered funds note that ESG funds continue to outperform their peers. Morningstar notes this “hearty” overperformance in its Q1 2023 summary: “Over the trailing three- or five-year period, an investor seeking long-term returns would have been better off in a sustainable fund than in one of its conventional peers.” While similar comparative data is unavailable for private funds, it is possible that one component of the demand for ESG-focused funds is that these funds need not give up investment returns in order to achieve ESG goals.

Source: GIIN Survey Data and Market Sizing Reports. Most recent: 2022

Source: Morningstar Direct, Data as of March 2023

Source: Morningstar Direct, Manager Research. Data as of March 2023.